BBL Online Starter Guide

Welcome to Better Benefits Life! We've compiled 95%+ of what you need to know about Final Expense life insurance into just 3 pages. We always encourage you to ask us questions and read your policy.

What is Final Expense Life Insurance?

Final Expense insurance is a whole life insurance policy that is designed to pay for your funeral costs, medical bills, and/or any other final expenses you may have.

Final Expense insurance is often called burial or funeral insurance, but so long as it is a whole life insurance policy, these names all mean the same thing.

The basic features of whole life (including Final Expense) policies are:

- A tax-free death benefit. Upon your death, the insurance company will pay out the death benefit to a beneficiary (or beneficiaries) of your choice. The payment is typically made within 48 hours. There are no restrictions on what the money can be used for, so your loved ones can cover your funeral costs, medical bills, or any unique wishes or obligations you may have.

- Permanent coverage. Your coverage will never expire or decrease. As long as you continue to pay the premium, your policy will be secure.

- Fixed premium. Once you have a whole life insurance policy in place, your premium will never increase. Premiums are typically paid monthly, but most carriers will allow you to pay quarterly or annually if you desire.

- Cash value accumulation. A small portion of your premium payments are sent to your cash value account which typically earns interest. Cash value can be used in multiple ways, including preserving some of your coverage if you are no longer able to afford your premiums. Learn more about cash value here.

The features that make Final Expense unique from traditional whole life insurance are:

- More affordable coverage options. Final Expense insurance is usually offered for coverage ranging anywhere from $1,000 - $50,000. Traditional whole life typically starts at a minimum of $25,000. Coverage amount is one of the top factors that determines insurance pricing, meaning smaller Final Expense policies can offer more affordable options compared to traditional whole life.

- Easier qualification process. There is no medical exam required for Final Expense insurance whereas many traditional whole life products do require a medical exam. Furthermore, the requirements for Final Expense coverage are usually more lenient than for traditional whole life. This means you may get approved or get a better price for Final Expense insurance compared to getting denied or a higher price for traditional whole life.

Does Final Expense provide immediate coverage?

Thanks to the selection of carriers we work with, most customers are able to qualify for immediate coverage, even if they have been told they needed to be on a 2-year waiting period elsewhere. We will never recommend a product with a waiting period if you can qualify for immediate coverage.

Most insurance carriers offer immediate coverage, but it requires that you medically qualify. Although there is no medical exam, you will have to answer basic health questions and provide the insurance company with consent to electronically check your medication history.

Every carrier has different standards and requirements. For example, if you have COPD, you will be denied immediate coverage by some carriers, but others will approve it. This is why we work with 15+ insurance carriers. We've selected each carrier because any one of them may be the best carrier for you, depending on your unique health status and history.

Unfortunately, some high-risk health issues require a waiting period with every carrier. It is important to understand the details about your waiting period since they are not all the same.

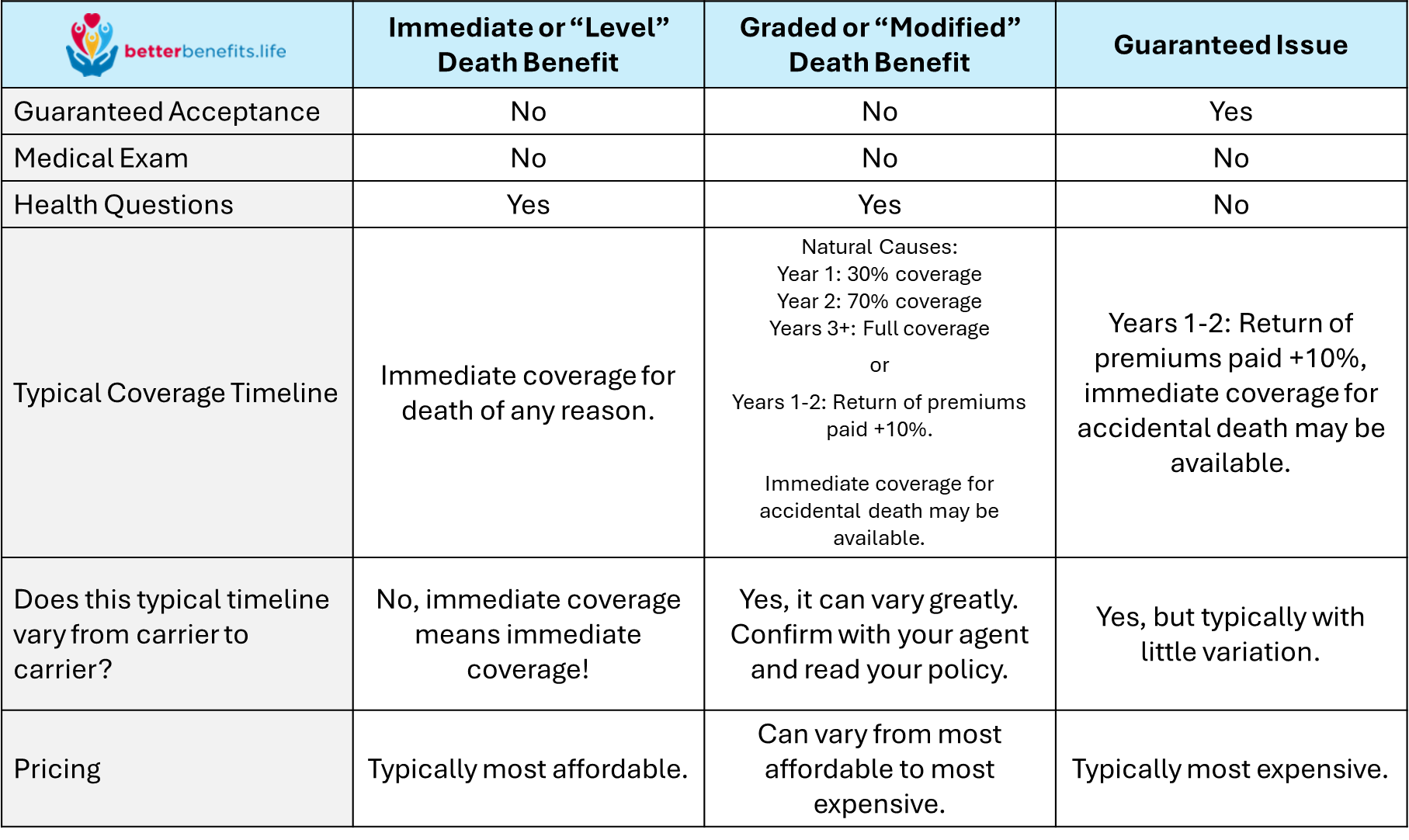

Below is a simple table outlining the three main types of Final Expense coverage. Of course, immediate coverage is preferred, but if you cannot qualify for immediate coverage, we may still be able to offer you an affordable policy.

If you would like a more detailed explanation of these different policies, we've written one here.

Is there anything else to consider?

Most customers consider the coverage start date, coverage amount, and price to be the most important factors. These are also the factors that vary the most among the various insurance carriers. However, Final Expense policies have additional features called "Riders." Some Riders are free, and some are not. Carriers typically offer these riders on their Immediate Coverage plans and typically don't offer them on their Graded/Guaranteed plans.

Below are the two most common Riders.

- Terminal Illness Rider. This Rider is typically free. The Terminal Illness Rider adds a provision to your policy that states you may collect a certain amount of your death benefit prior to your death if you have been diagnosed with a terminal illness. The amount varies between policies, but a typical amount is 50% of the death benefit. There are usually no restrictions on what you can spend the money on, so you can use it to cover medical bills, take a vacation, or anything else.

- Accidental Death Benefit ("ADB"). This rider is typically not free. The ADB Rider pays an additional death benefit if you happen to pass away in a non-medical accident (car crash, plane crash, etc.). The additional amount is often 100% of the standard coverage amount for natural causes and costs only a few dollars a month, although some carriers will try to upsell additional coverage that can materially increase your premiums. Every carrier will have certain restrictions (e.g., exclusions for scuba diving, skydiving, etc.).

It is important to note that while some Riders are "free," they may still come at a cost. For example, Carrier A may cost $40/month and offer a free Rider, while Carrier B costs $30/month and does not offer that Rider. While you can't make Carrier A any less expensive by declining the Rider, it will effectively cost you an additional $10/month.

We generally don't make recommendations based on Riders unless you have a specific need or have two options that have the same coverage start date, same coverage amount, and very similar pricing. We are always honest and upfront about what Riders your policy does and does not have, and which Riders affect the cost, whether they are "free" or not. Unfortunately, Riders are one of the most common items used to "upsell" by agents since they are more subjective than the other components like coverage amount and price.